In this section, we present the key concepts that are needed to apply the usual large sample approximations in regression analysis with time series data.

Stationary Stochastic Process

A stationary time series process is one whose probability distributions are stable over time in the following sense: if we take any collection of random variables in the sequence and that sequence ahead h time periods, the joint probability distribution must remain unchanged.

In mathematical form, the stochastic process { xt : t = 1, 2, ..... } is stationary if for every collection of time indices 1 <= t1 < t2 < t3 .... < tm, the joint distribution of (xt1, xt2, ..... , tm) is the same as the joint distribution of (x(t+h), x(t+1 + h), ....., x(tm+h)) for all integers h >= 1. One implication (by choosing m = 1 and t1 = 1) is that xt has the same distribution as x1 for all t = 2, 3, .... which means that the sequence { xt : t = 1, 2, .... } is identically distributed. Furthermore, the joint distribution of (x1, x2) must be same as the joint distribution of (xt, x(t+1)) for any t >= 1. Again, this places no restrictions on how xt and x(t+1) are related to one another.

Requirement for Stationarity

1) the sequence {xt : t = 1, 2, ... } is identically distributed.

2) the nature of any correlation between adjacent terms is the same across all time periods. (including joint distribution)

Covariance Stationary Process

A stochastic process {xt : t = 1, 2, .....} with a finite second moment [E(xt^2) < ∞] is covariance stationary if

1) E(xt) is constant

2) Var(xt) is conatant

3) for any t, h >= 1, Cov(xt, x(t+h)) depends only h and not on t.

Covariance stationarity focuses only on the first two moments of a stochastic process: the mean and variance of the process are constant across time, and the covariance between xt and x(t+h) depends only on the distance between the two terms, h, and not on the location of the initial time period, t.

If a stationary process has a finite second moment, then it must be covariance stationary, but the converse is certainly not true. Sometimes, to emphasize that stationarity is called to strict stationarity to distinguish covariance stationarity which is a relatively weaker requirement.

How is stationarity used in time series econometrics? On a technical level, stationarity simplifies statements of the law of large numbers and the central limit theorem. On a practical level, if we want to understand the relationship between two or more variables using regression analysis, we need to assume some sort of stability over time.

Weakly Dependent Time Series

Corr(xt, x(t+h)) -> 0 as h -> ∞

Weak dependence places restrictions on how strongly related the random variables xt and x(t+h) can be as the time distance between them, h, gets larger. A stationary time series process { xt: t = 1, 2,... } is said to be weakly dpendent if xt and x(t+h) are "almost independent" as h increases without bound. Covariance stationary sequences can be characterized in terms of correlations: a covariance stationary time series is weakly dependent if the correlation between xt and x(t+h) goes to zero "sufficiently quickly " as h -> ∞. In other words, as the variables get farther apart in time, the correlation between them becomes smaller and smaller. Covariance stationary sequences where Corr(xt, x(t+h)) -> 0 as h -> ∞ are said to be asymtotically uncorrelated.

Then, why is weak dependence important for regression analysis?

It replaces the assumption of random sampling in implying that the law of large numbers(LLN) and the central limit theorem(CLT) hold. The ost well known central limit theorem for time series data requires stationarity and some form of weak dependence: thus, stationary, weakly dependent time series are ideal for use in multiple regression analysis.

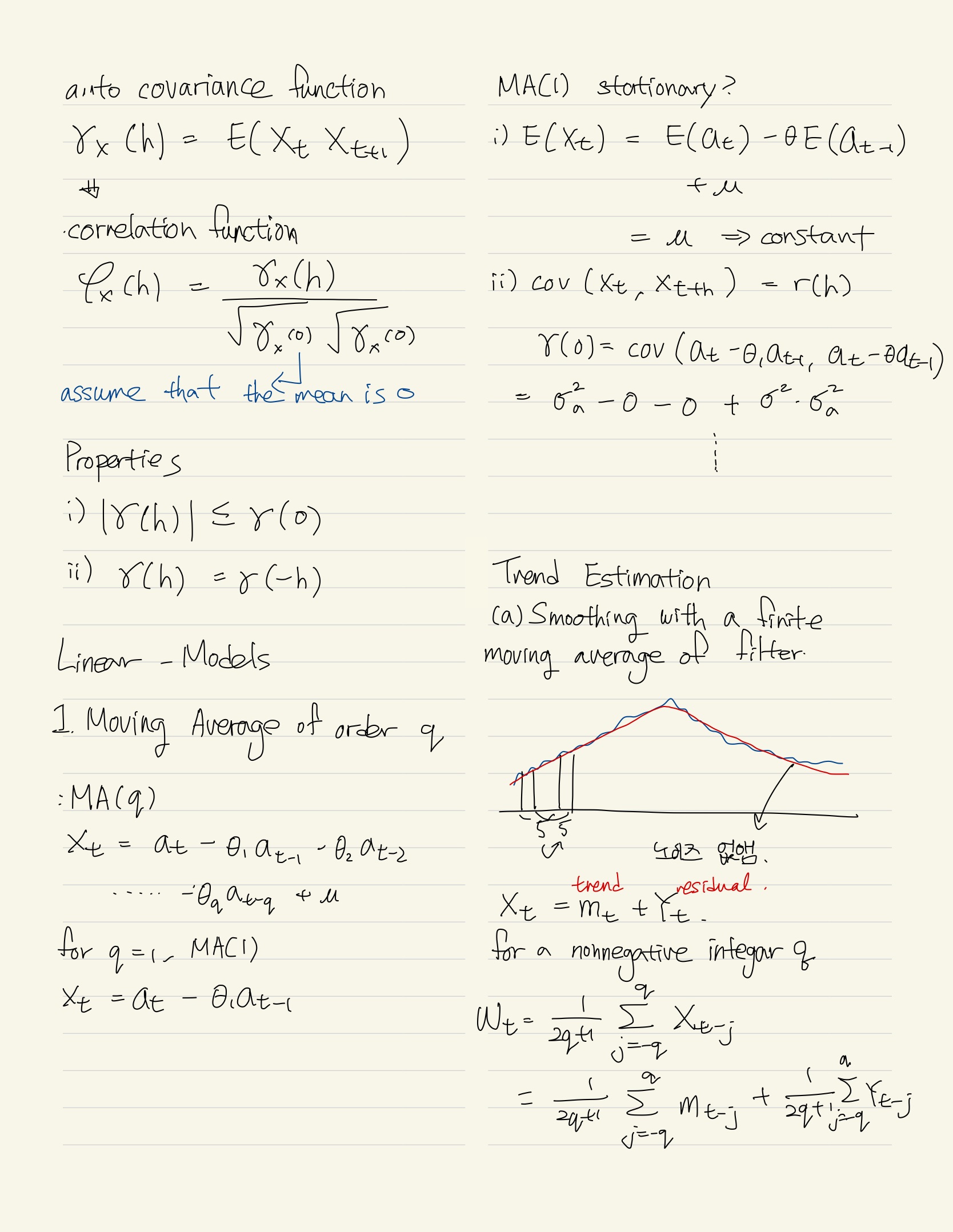

Moving average process of order one [MA(1)] : xt is a weighted average of et and e(t-1)

xt = et + αt*e(t-1), t = 1, 2, 3,.....,

where {et : t = 1, 2, 3....} is an i.i.d sequence with zero mean and variance σe^2.

Ma(1) process is weakly dependent. Adjacent terms in the sequence are correlated:

because x(t+1) = e(t+1) + α1*et, Cov(xt, x(t+1)) = α1, Var(et) = α1*σe^2.

Because Var(xt) = (1 + α1^2)*σe^2, Corr(xt, x(t+1)) = α1/(1+ α1^2).

x(t+2) = e(t+2) + α1*e(t+1) is independent of xt because {et} is independent across t. Due to the identical distribution assumption on the et, {xt} is actually stationary. Thus, an MA(1) is a stationary, weakly dependent sequence and the law of large numbers and the central limit theorem can be applied to {xt}.

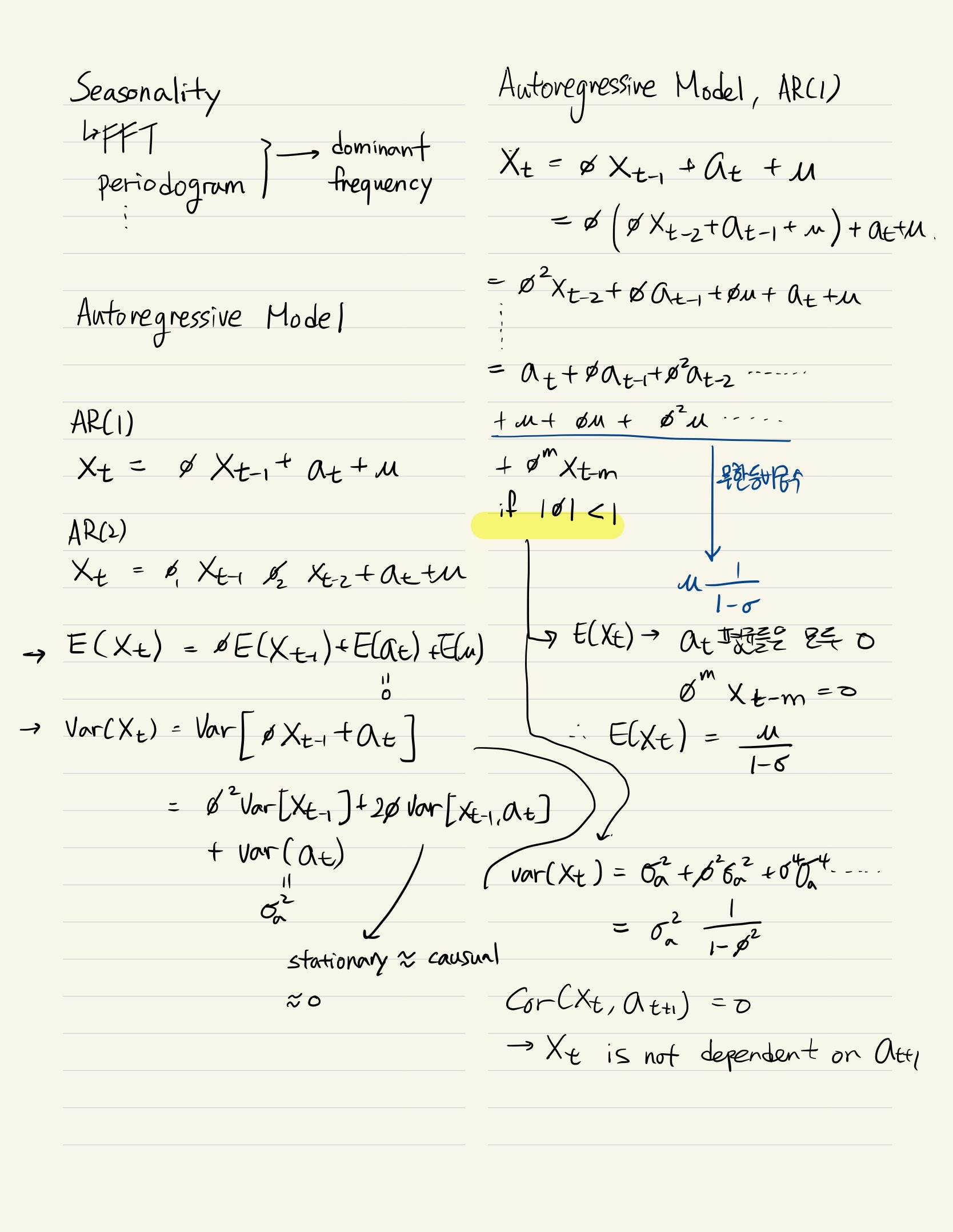

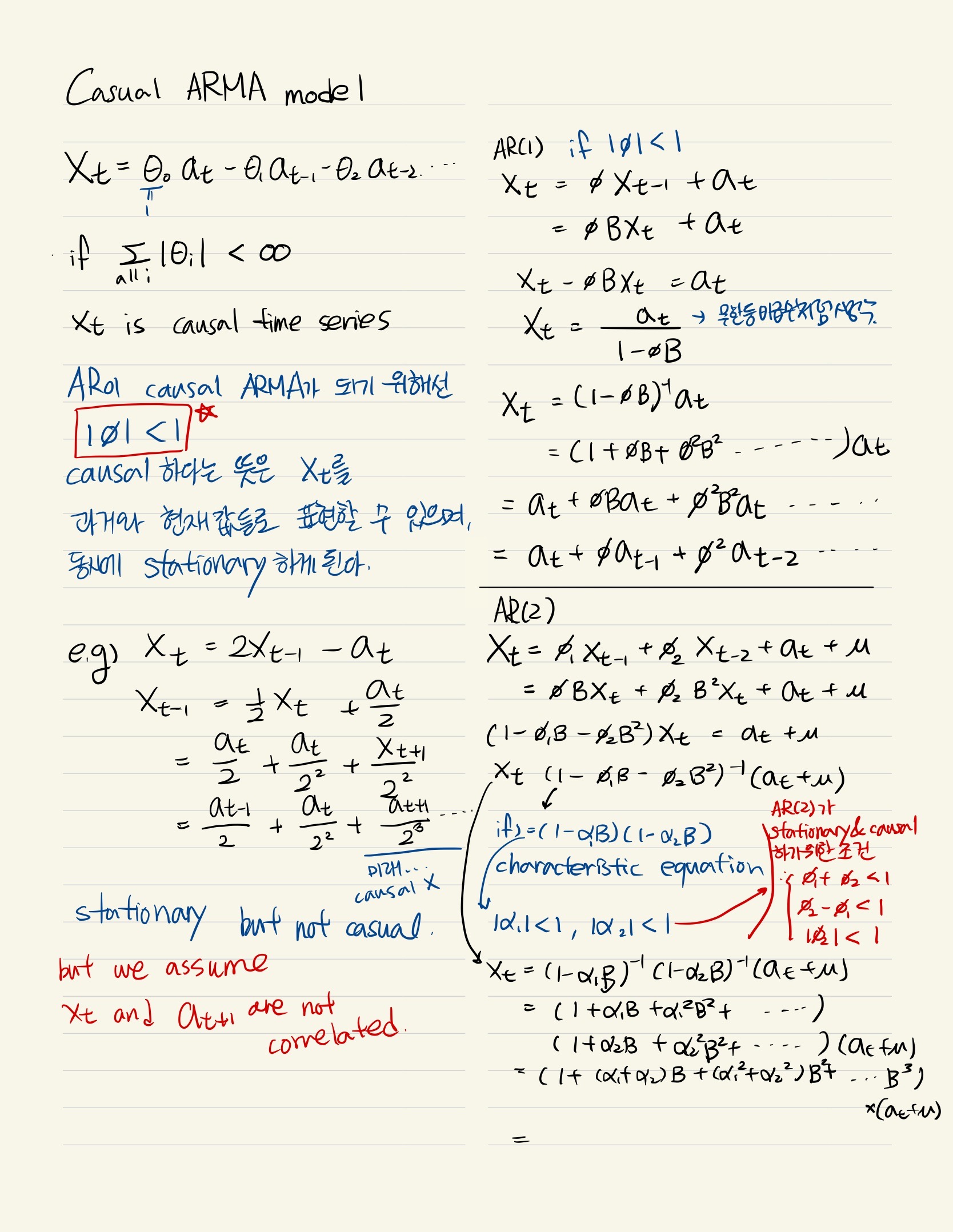

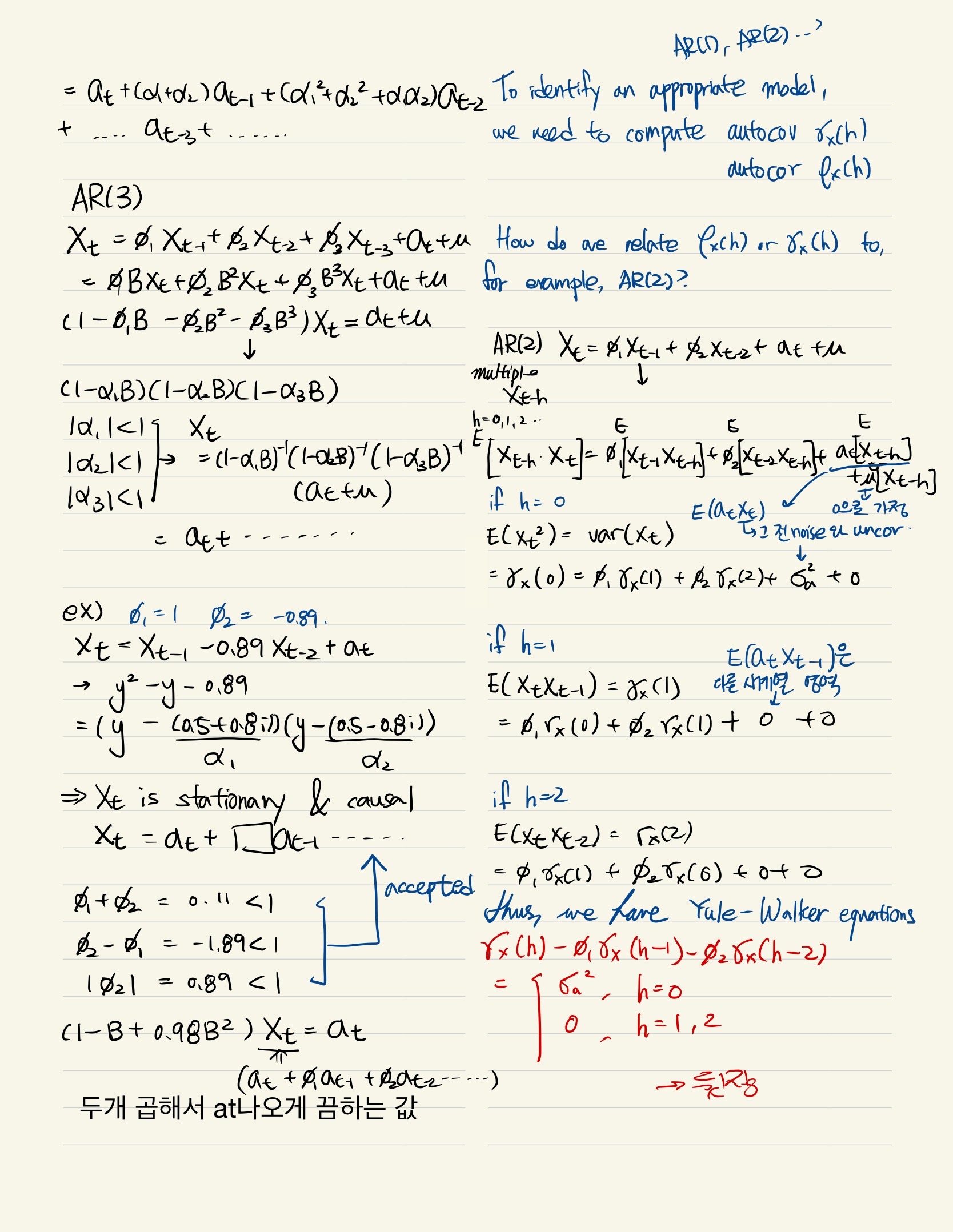

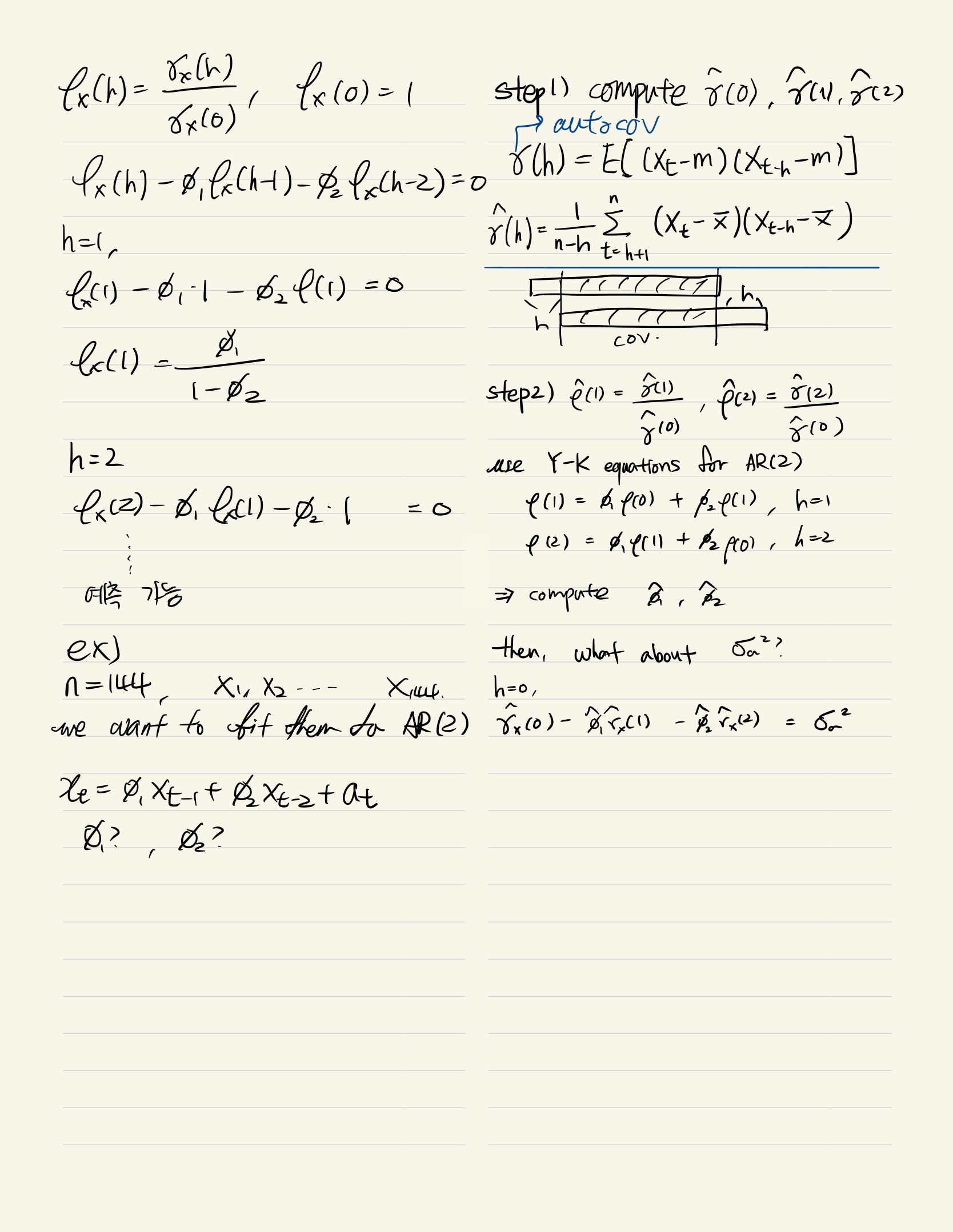

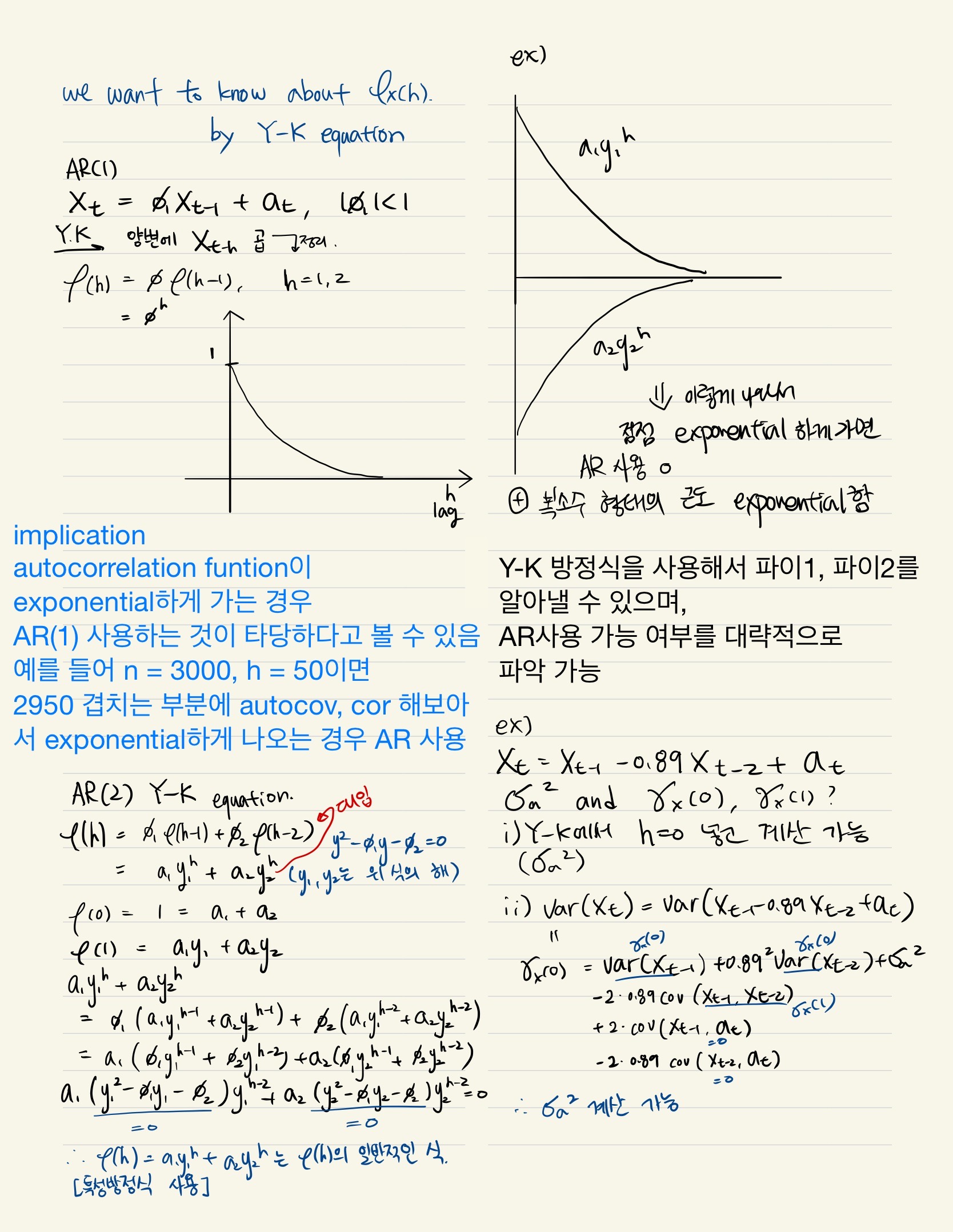

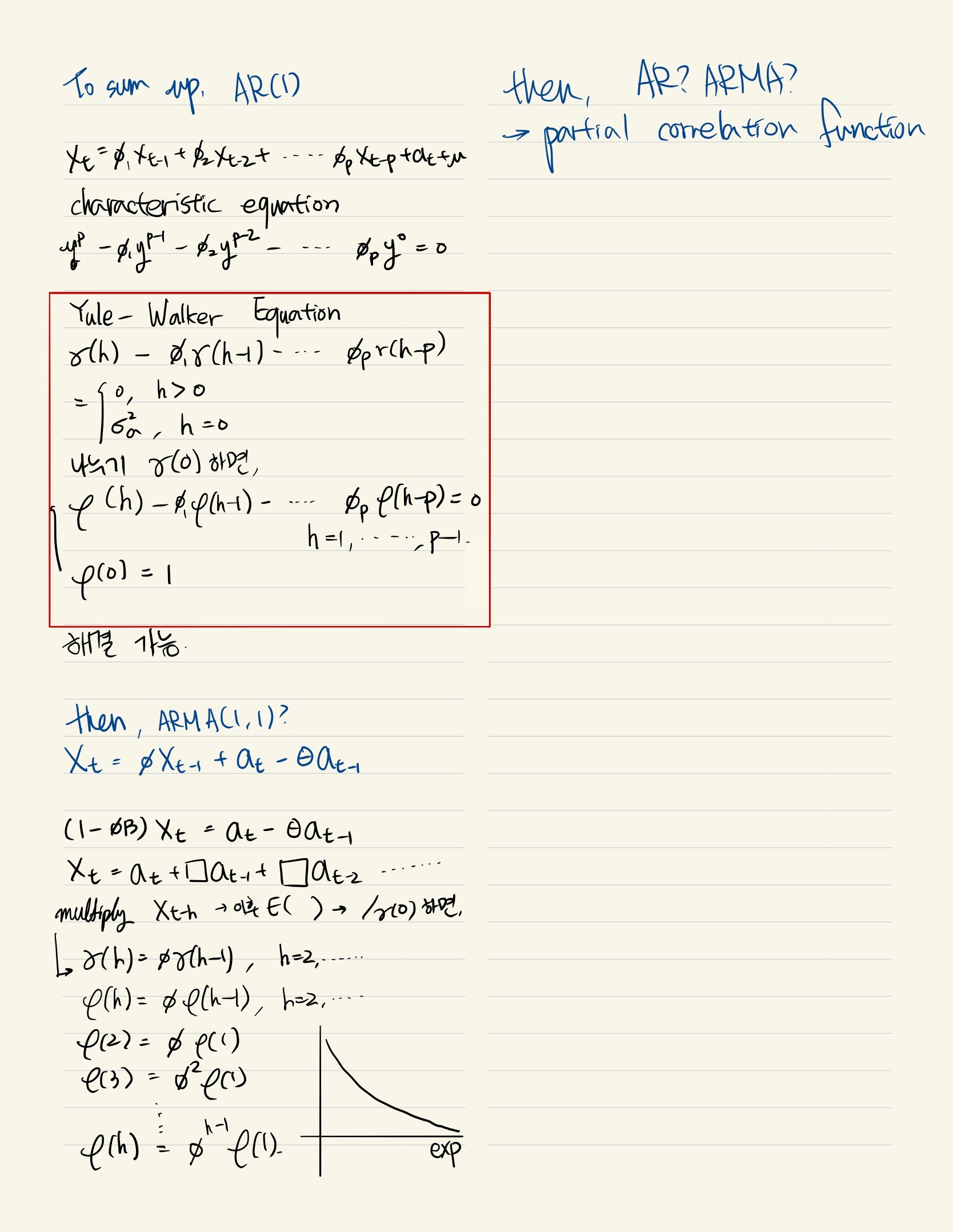

Autoregressive process of order one {AR(1)]

yt =ρ1*y(t-1) + et, t = 1, 2, ......

the starting point in the sequence is y0 (at t = 0), and { et : t = 1, 2, ... } is an i.i.d. sequence with zero mean and variance σe^2. The crucial assumption for weak dependence of as AR(1) process is the stability condition |ρ1| < 1. {yt} is a stable AR(1) process.

To see that a stable AR(1) process is asymptotivally uncorrelated(weakly dependent), it is useful to assume that the process is covariance stationary.

E(yt) = E(y(t-1)) - these are constant variables from requirement of covariance stationary.

and with ρ1 is not 1, this can only be possible if E(yt) = 0.

Var(yt) = ρ1^2Var(y(t-1)) + var(et)

and under covariance stationarity (Var(yt) = Var(y(t-1))),

σy^2 = ρ1^2*σy^2 + σe^2.

Since ρ1^2 < 1,

σy^2 = σe^2/(1-ρ1^2)

y(t+h) = ρ1y(t+h-1) + e(t+h) = ρ1(ρ1y(t+h-2) + e(t+h-1)+ + e(t+h)

= ρ1^2*yt + ρ1^(h-1)*e(t+1)+.....p1*e(t+h-1) e(t+h)

Due to E(yt) = 0 for all t, Cov(yt, y(t+h)) = E(yt, y(t+h)) = ρ1^h*σy^2 (중간 과정 생략)

Corr(yt, y(t+h)) = Cov(yt, y(t+h))/(σy*σy) = ρ1^h

Corr(yt, y(t+1)) = ρ1

Corr(yt, y(t+h)) is important because it shows that, although yt and y(t+h) are correlated for any h >= 1, this correlation gets very small for large h : because |ρ1| < 1, ρ1^h -> 0 as h -> ∞. Thus, this analysis demonstrates that a stable AR(1) process is weakly dependent.

Resource : Jeffrey M. Woolderfige, "Introductory Econometrics : A Modern Approach 5th edition"